What lies ahead for 2026, and why polarizing views on AI are the market’s biggest risk.

We will begin our 2026 market outlook with a thought experiment:

Let’s say that in March 2020 during the era of peak panic during the COVID-19 pandemic, you took shelter in a well protected vessel with no access to the internet or the outside world. Today, you exit that vessel 5+ years later and receive a snapshot of the stock market and the economy.

You discover that since March 2020, the S&P 500 has returned 196% (a nearly 3x return in 5 years), the Nasdaq has gained 262%, corporate earnings just grew 12% year-over-year, US GDP has been growing at a healthy 2-3% pace (with Q3 2025 GDP coming in at 4.3%), US unemployment sits at 4.6%, and US inflation is at a reasonable 2.7%.

You also learn that over the last 3 years the S&P 500 gained 24%, 23%, and 15% respectively, with the gains driven by a revolutionary new technology called generative AI, which can turbocharge your productivity at work to get things done faster.

I think most of us, in a vacuum, would be thrilled with this picture and assume that the US is enjoying another rendition of the Roaring Twenties.

However, you are surprised to learn that this is not the case. Instead, you find out that consumer sentiment is near its lowest levels in 10 years (even worse than the days of the pandemic when the global economy was shut down), 61% of Americans believe that the economy is not working well for them, and a higher than average number of asset managers are bearish on the stock market.

How could sentiment be so disconnected from all of these glowing headline figures?

The answer is that the world at large has not been on the express train to prosperity. Many investors refer to this dynamic as the K-shaped economy, where one cohort ascends upward and the other downward (like the right side of the letter K). I will refer to it as the Polar Express, with two sides (politically, economically, and in markets) feeling as if they are headed in opposite directions.

Polarization is our key theme heading into 2026 – it is a landscape that presents abundant opportunity as well as a number of risks that could derail this bull market. And when we say polarization, we are not only talking about Red vs. Blue. Increasingly, whether one looks at the economy, the stock market, the political landscape, and even views on AI, it is as if we live in two completely different worlds.

Polarization of Global Economy

The first reason why not everyone is cheery about the economic landscape is because the economic outcomes have been bifurcated across a number of spectrums.

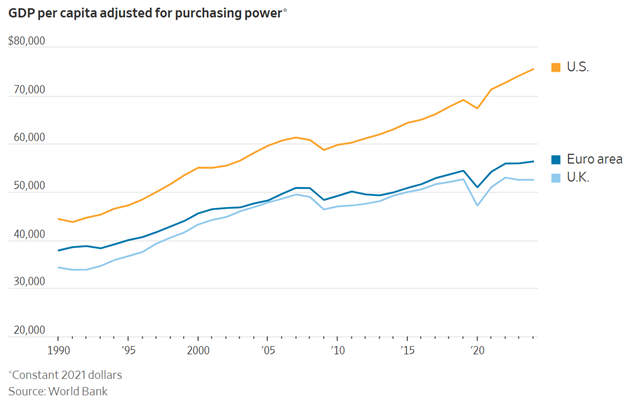

The first is geographically: while most of the developed world’s economies have been stuck in neutral since the 2008 Financial Crisis, the US has raced ahead.

The US has generated superior economic growth vs. the rest of the world because of technology and innovation. The US has more tech companies generating $1bn of profit than the rest of the world combined, and some of these tech companies individually are worth more than most major stock markets globally.

Source: Goldman Sachs

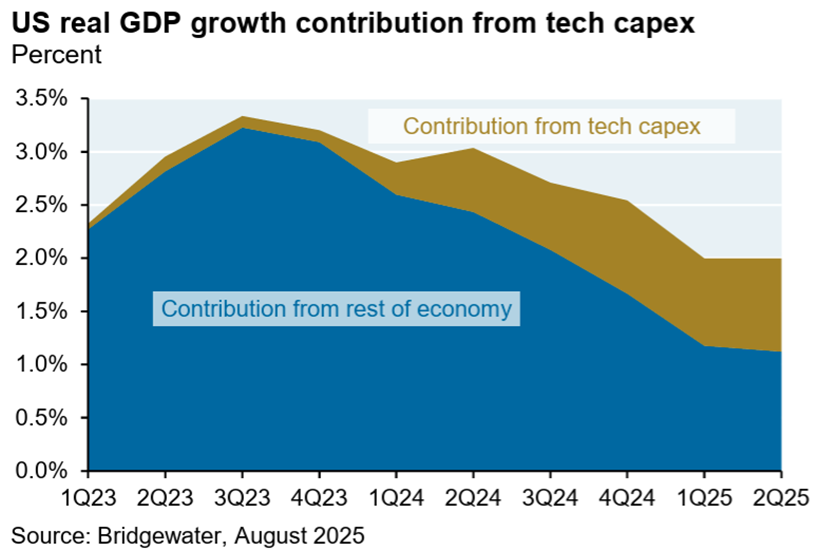

Not only is the global economy bifurcated between the US and rest of world, within the US we have seen a dramatic difference in economic outcomes from the technology sector vs. the rest of the economy.

Since 2023 (when generative AI began to take off), GDP growth in the US has been fairly stable at 2-3%. Beneath the surface however, AI capex has been a significant boost to GDP growth while the rest of the economy has slowed meaningfully. AI has masked a meaningful slowdown on Main Street.

These trends have had broader societal implications, with owners of assets (particularly technology assets) enjoying strong gains in their portfolios while the rest of the economy feels momentum slowing down while also experiencing high prices on the items they buy.

It is important here to distinguish between price levels and inflation (changes in price). Prices are high relative to where they were 5 years ago, and our view is that prices will not go back down (unless we see another global financial crisis, which would be worse). That is why the focus is on inflation (the rate at which prices are rising), which remains contained at 2.7% despite an increase in tariffs this year.

The solution to the affordability crisis, which has been a key driver of consumer sentiment woes, will not be lower prices. Rather, it will be wages rising faster than prices, thereby increasing purchasing power and making goods/services more affordable. The good news is that wages have been growing faster than prices (wage growth over the last year stands at 3.9% vs. 2.7% for inflation).

This trend of wages rising faster than prices must sustain for a while in order for Americans to feel better about their economic picture. The key to this will be productivity growth, enabled by AI. More on that later.

Polarization of the Stock Market

Even for those who have benefitted from rising stock prices, we find that many investors continue to harbor a healthy dose of skepticism. This has been a 3 year bull market that has not been as celebrated as bull markets in the past.

The primary culprit could be that most companies in the market have not enjoyed the same types of performance as the headline indices. Aside from a brief 6 month period to start 2025, the stock market has largely been a one trick pony – you have wanted to own US large cap tech companies that are leading in AI. Everything else has not come close.

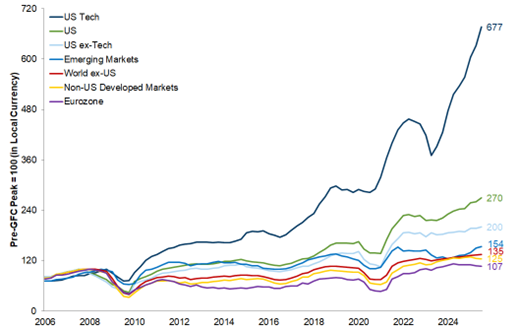

Over the last 5 years, non-US stocks have returned 8.4% per year while the US has returned 15.3% per year. While skeptics will point to a number of excuses for why the US has persistently outperformed, the key factor has been superior earnings growth from the US driven by tech.

The below chart shows the earnings growth of various market segments, and US tech is clearly a standout:

Source: Goldman Sachs

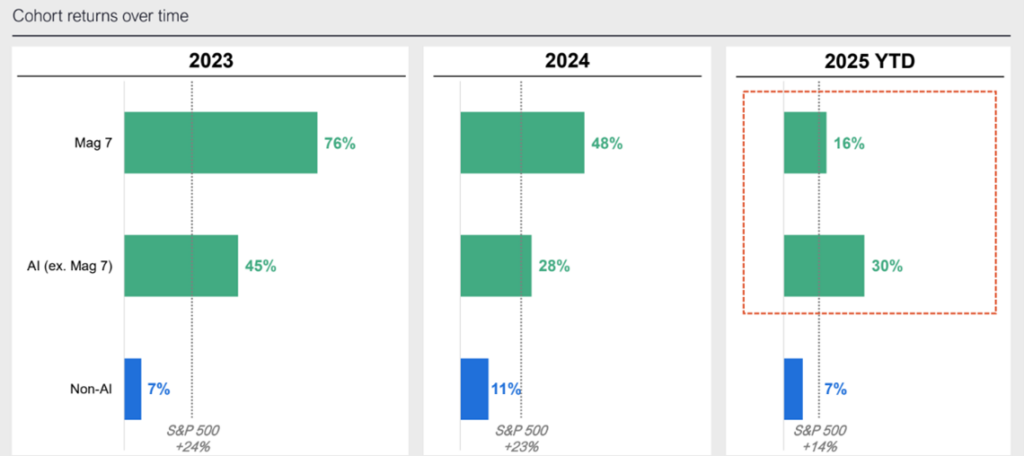

This superior earnings growth from US tech companies has led to, and justified, the superior stock price performance of this cohort. Over the last 3 years, AI winners have generated the majority of the gains in the stock market. Outside of AI, returns have been merely average:

Source: Coatue Management

Perhaps the best chart to illustrate the concentration of both the economy and the stock market is below. The top 10 companies in the S&P 500 are now worth 77% of US GDP, and 8 of these 10 companies are tech companies. Venture capitalist Marc Andreessen proclaimed in 2011 that software was eating the world. This chart proves that he was right.

Source: Coatue Management

Polarization of Artificial Intelligence

What the last two sections have shown us is that AI has been a meaningful driver of the rosy picture we laid out at the start of this report. Without the rise of AI in 2023, it is hard to imagine that the US economy would be growing at 4.3% last quarter, or that the stock market would have gone up 80% over the last 3 years.

Yet, we find a significant amount of negativity and concern surrounding AI, which we believe is one of the biggest risks facing investors in 2026. It is not the substance of the concerns that worry us – it is that this technology is facing such pronounced backlash that it could slow down AI adoption and therefore derail this bull market.

Ipsos, a leading polling firm, conducted a survey of over 1,000 US adults. They found that 53% of respondents use AI regularly and that AI has changed their lives. However, 63% of the respondents from the same survey said that products that use AI make them nervous.

Among the concerns we hear:

- AI is not as effective as everyone thinks

- AI could put many Americans out of work

- Tech companies are overspending on AI

- The valuations of AI companies are extreme

(Hard to imagine items 1 and 2 both being true at the same time.)

On point 1 (AI model performance), see our July Letter where we shared data on the consistent improvement in AI model performance over the last several years.

On point 2 (labor market impact), we receive this question a lot, and believe this is the source of most of the anxiety among Americans. The last 200 years has been filled with world changing innovations. At each step of the way, there was concern that the new technology would put legacy industries out of business. While that ended up being true, employment did not suffer over the long-run (the US employs more people than ever).

However, some feel that AI is different, and that we should fear widespread job loss as a result. We would point to the radiology industry as a counterargument to that claim. In 2016, a leading AI researcher named Dr. Geoffrey Hinton proclaimed that radiologists would be obsolete in 5 years due to AI. Radiology has been an area of early adoption for AI (surveys indicate over 2/3 of radiology departments are using AI, primarily for automated image analysis and detection). However, a recent study from the American College of Radiology noted that the industry is experiencing significant growth in demand for radiologists, and project a steady growth rate for at least the next 30 years.

How could there be so much AI adoption in this industry yet the number of workers is actually growing? Productivity. AI is allowing radiologists to increase their work efficiency – by reading images faster and diagnosing more quickly, they can see more patients and increase profitability for their employers, who can then hire more people. A virtuous cycle of productivity.

Our base case is that AI over the long-run will deliver similar productivity benefits across the working population and be an engine for new job creation. Yes, we expect some jobs to become obsolete, but at the macro level we view AI as a net positive over the long-run.

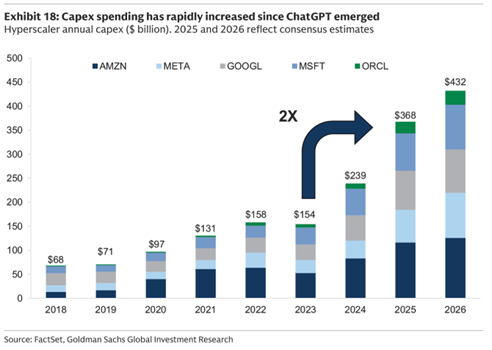

On point 3 (tech companies overspending on AI), there is no question that the tech industry is betting the farm on AI.

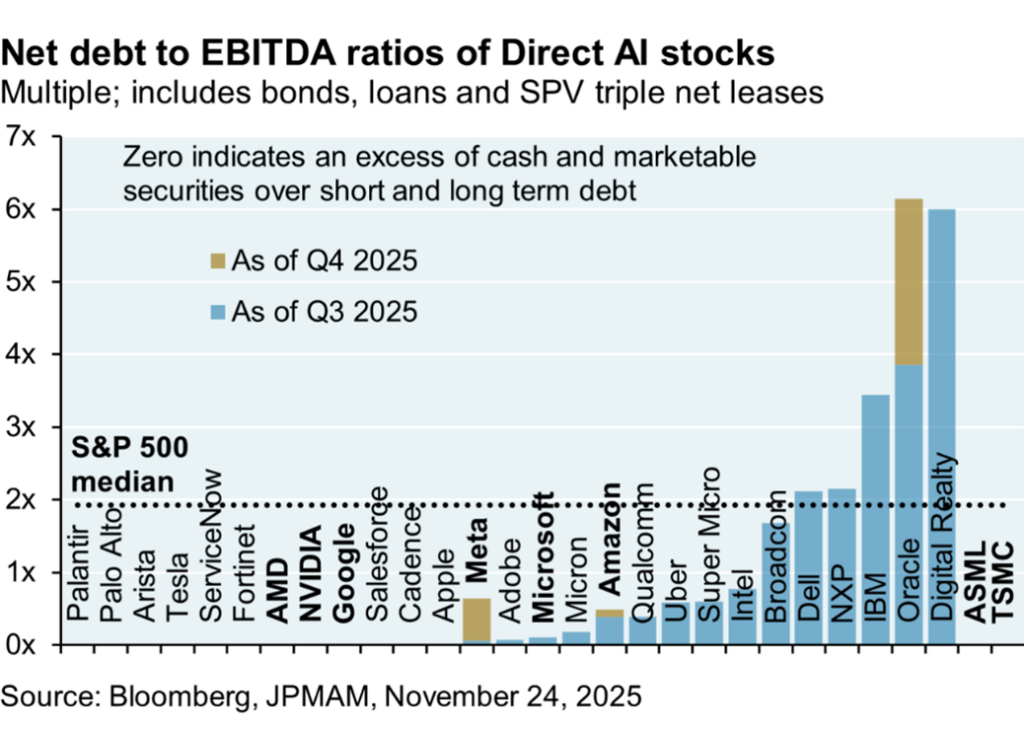

However, at this stage, our view is that outside of a couple of overly aggressive businesses, most of the industry has the capital to fund their investment plans. The below chart shows the amount of debt relative to profit (EBITDA) for AI stocks. All but 3 public AI companies have a lower/equal debt ratio than the average S&P 500 company. This suggests that most of the AI businesses are not overburdened with debt at the moment, and are funding their AI investments with free cash flow.

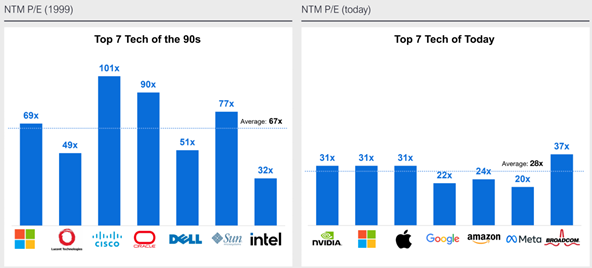

Lastly, regarding point 4 (valuations are extreme), we note that there are certainly pockets of over-exuberance in the market, but most of the AI leaders continue to trade at reasonable (albeit slightly elevated) valuations.

The top 7 tech companies today, while a little more expensive than the broader S&P 500 (which trades at 23x earnings), are 60% cheaper than their dot-com bubble peers.

Source: Coatue Management

Our 2026 Outlook – and why this all matters

It may seem odd to spend 1,900 words talking about polarization in a market outlook. The reason why it all matters:

- Global economic growth has been driven by the US

- US economic growth over the last 3 years has been driven by AI

- AI has delivered the majority of stock market gains

- The top tech/AI companies now make up a large percentage of the indices

- Therefore, the AI theme is the key to another strong year for stocks in 2026

If the economy and the stock market are reliant on AI adoption and monetization, it concerns us that sentiment surrounding AI remains so polarized. If public sentiment continues to be sour, we would expect adoption to organically slow, and a further hurdle could come from lawmakers who follow the wishes of their constituents to provide further speed bumps for the AI build-out (we are already seeing AI become a political lightning rod).

And, in the near-term, the clock is ticking on AI monetization (the market is expecting the tech sector to grow earnings at 29% in 2026). Yes, big tech companies have enough money today to fund their AI investments. But the market will only be patient for so long. If AI profits are slow to materialize while another $400bn+ of capital is invested in AI infrastructure, AI stocks could face a meaningful correction (these innovation waves are rarely a linear march upward). Valuations are high (S&P 500 22x P/E), expectations for earnings growth are high, and that leaves the market vulnerable to disappointment.

Another wildcard is IPO activity, a fairly reliable indicator of the end of bull markets. If we see a surge of IPO activity from AI leaders like OpenAI and Anthropic, that could be another warning sign that it is time to take profits.

On the flip side, the headline figures all point to a very healthy picture, albeit largely tied to AI (strong GDP growth, moderate unemployment, moderate inflation). The market is also expecting 15% earnings growth from the S&P 500 in 2026. We anticipate further rate cuts from the Federal Reserve in 2026 given the upcoming nomination of a new Fed chair (we believe much of the benefit is likely priced in, but further cuts won’t hurt the market either).

This leaves us facing a wide range of potential outcomes in the new year. We have published quite bullish commentary (correctly) for much of the last 3 years, with a brief period of caution during the 1st half of 2025 (which did prove to be a highly volatile period). Each step of the way, we unequivocally stated that there would be no bear market in 2023, 2024, or 2025. However, in 2026, nothing would surprise us.

Our base case, however, is that the bull market remains in-tact for another year given the economic tailwinds in place currently, and we would err toward forecasting another positive year for stocks, but we are cognizant of the risks we have outlined above. If we see AI-related IPO activity surge, or if we see AI negativity having a meaningful impact on tech company earnings, we would likely adjust our forecast to the downside.

While it is commonplace to share our outlook for the year ahead, we are primarily focused on delivering strong long-term performance, and we are bullish on AI over the long-term. AI models will continue to get better, anxiety regarding job loss will eventually subside, and AI will become a big part of everyday life, driving productivity gains globally. As such, we continue to be optimistic about venture capital and growth-oriented investments for long-term portfolios.

For those disappointed to not see an S&P 500 price target for this year, I will share my nomination for “Chart of the Year”.

We wish you all a happy and prosperous 2026.