Why the slowdown in the labor market has not derailed the recent stock market rally.

Even for those of us who have been out of school for a long time now, the annual calendar turn from August to September evokes memories of returning to the classroom to kick off the academic year.

This September, the market chatter has been dominated by talks of a labor market slowdown, which also reminds me of some basic principles that I learned in my college economics classes.

Slower job growth = less purchasing power for consumers

Less purchasing power for consumers = slower economic growth

Slower economic growth = lower corporate profits

Lower corporate profits = lower stock prices

Throw in the wrench of higher tariffs, which come with their own set of negative equations for consumers and businesses, and one would expect a gloomy year for the stock market.

If only investing were as easy as those simple linear equations learned in school…

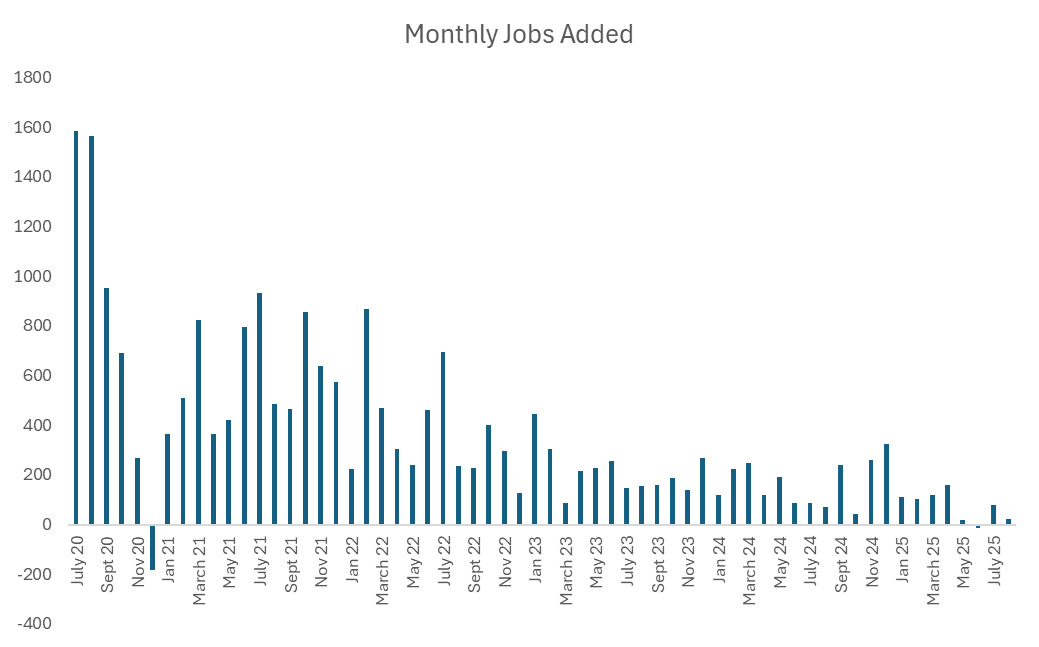

Over the last month, we have received several warning signs of a slowdown in job growth. In August, US employers added only 22,000 workers (well short of the 80,000 estimated by Wall Street). We also found out this week that the jobs figures from March 2024 to March 2025 had initially overstated the number of new jobs added by 911,000. That is a big number!

In total, through the first 8 months of 2025, we have had the slowest job growth in 15 years.

However, as I sit here writing this letter, a CNBC notification pops up on my phone “Stocks close at record highs despite job worries, looming inflation reports.” That about sums it up.

What explains this dichotomy between the headlines on the economy and the performance of the stock market?

#1 – Slowdown does not mean job losses

We have lived through a very unique period of time over the last 5 years, a period that started with a shutdown of the global economy. Consumers were flush with cash from COVID stimulus and excess savings from being stuck at home. They then spent like crazy, which led to heightened demand for goods and services sold by corporate America.

This led to shortages across both supply chains and employee bases. As society reopened post-COVID, we experienced a surge in hiring activity as a result. After the post-COVID surge, job growth has been steadily declining ever since, and nearly grinding to a halt over the last several months.

Source: Bureau of Labor Statistics, The 1911 Trust Company

The glass half full perspective is that companies have already hired all of the employees they need, and the job market has simply found equilibrium after a once in a generation shock to the system from COVID. There is merit to this argument.

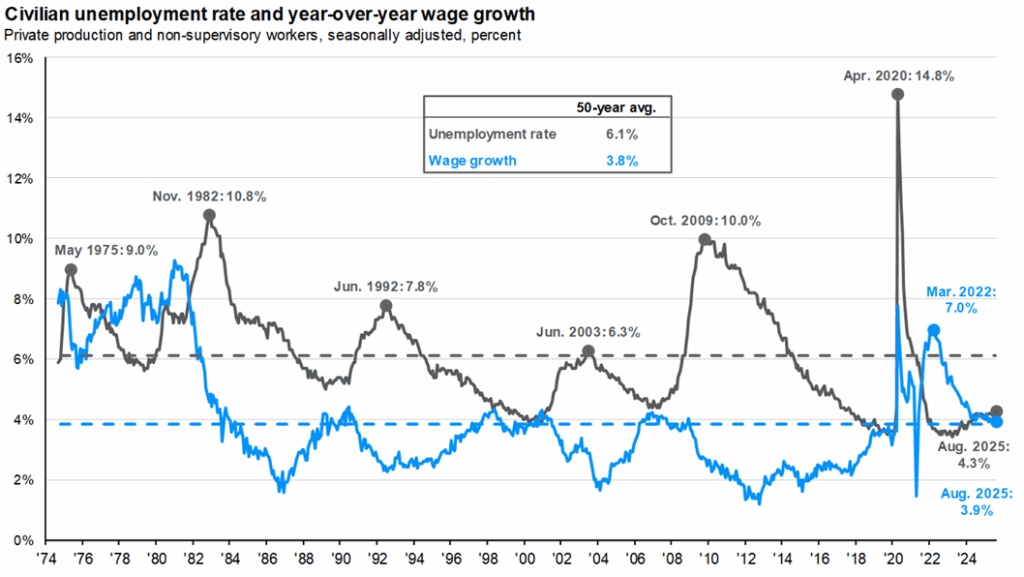

First, unemployment remains low at 4.3% and wages continue to grow at a healthy +3.9% clip. Both of these figures are better than historical averages.

Source: Bureau of Labor Statistics, JP Morgan

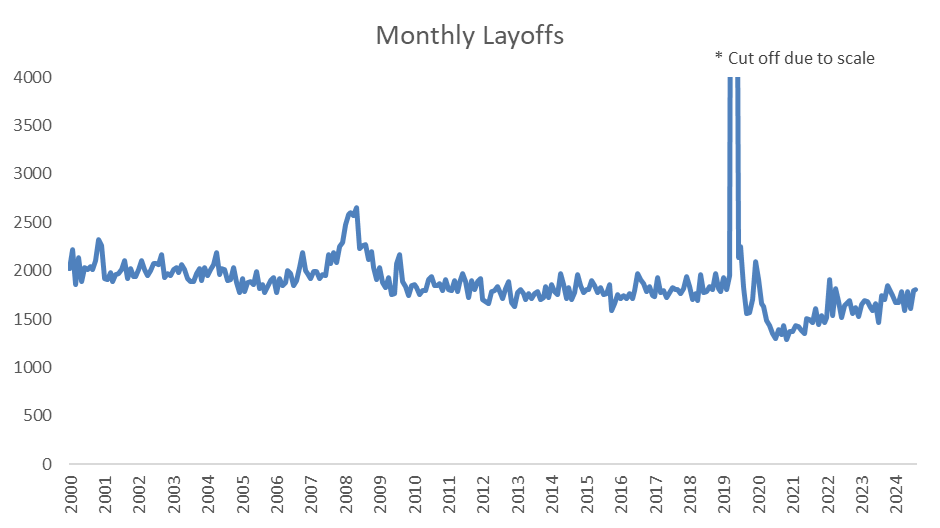

If companies were tightening the belt and reducing job growth because their business was struggling, one would expect slower wage growth and higher layoffs. We still have not seen that yet. As shown below, the rate of layoffs is below pre-COVID levels (which was also a period of stable economic activity).

Source: Bureau of Labor Statistics, The 1911 Trust Company

The glass half empty perspective is that a slowdown in hiring is the precursor to layoffs. Some leading indicators, such as consumer sentiment and small business surveys, do point to potential upside risks to the unemployment rate in the coming months. This is certainly possible, however we would tilt toward the hard data (shown above) over the soft data (surveys and sentiment) for the time being.

#2 – Full employment means healthy consumer

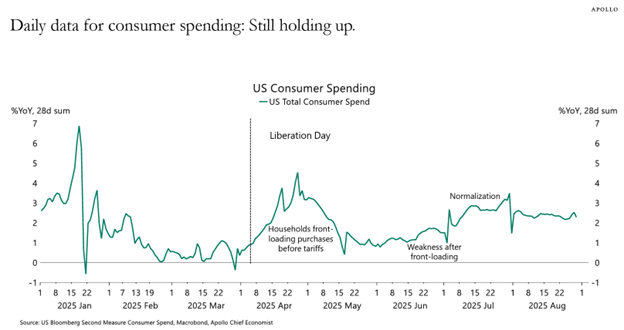

While job growth is slowing, America remains fully employed as discussed above and wages (+3.9%) are growing faster than prices (+2.7%). As a result, they can continue to spend. And they have. Consumer spending has remained fairly steady over the last 2 months, growing at 2-3% year-over-year, despite weakening job growth.

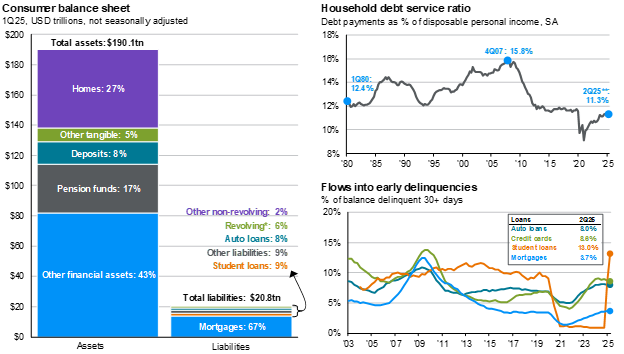

Consumers also enter this uncertain period with very healthy balance sheets and debt levels (something we did not see at the onset of the 2008 Financial Crisis). Household assets total $190 trillion, while household debt stands at $20 trillion. Debt payments as a percent of income stand at 11.3%, which is lower than any period pre-COVID.

Source: JP Morgan

This has all meant good things for corporate profits, which are the key determinant of stock prices over the long-term.

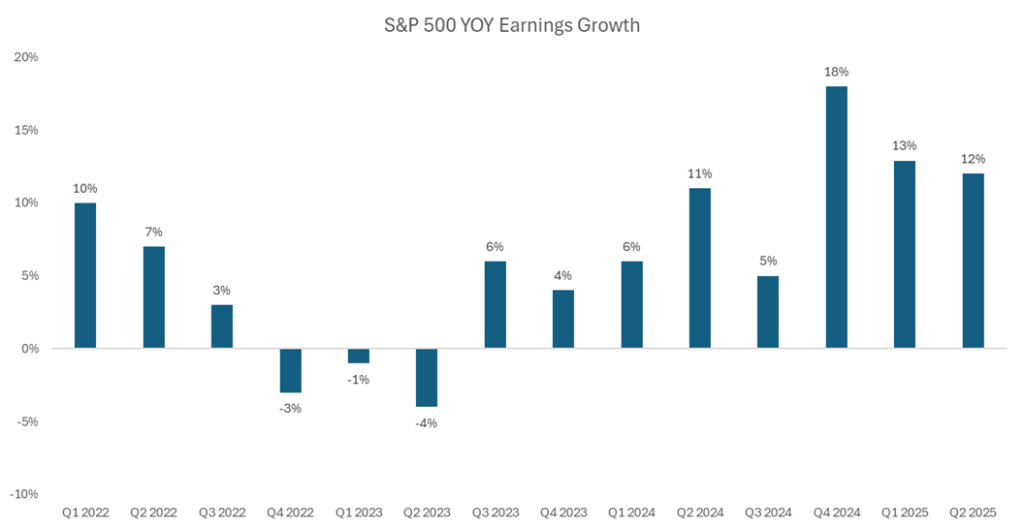

The S&P 500 has now posted 3 straight quarters of double digit earnings growth, blowing past expectations. Q2 2025, the first quarter of earnings reports post-Liberation Day, showed no major weakness in corporate profits.

These strong earnings figures have occurred during an extended period of tepid job growth, which has given the stock market some assurance that the economy remains on solid footing.

Source: Factset, The 1911 Trust Company

#3 – AI remains at the forefront

I won’t rehash the primary topic of our last letter, but obviously enthusiasm surrounding AI has also helped the stock market during this period of labor market concern.

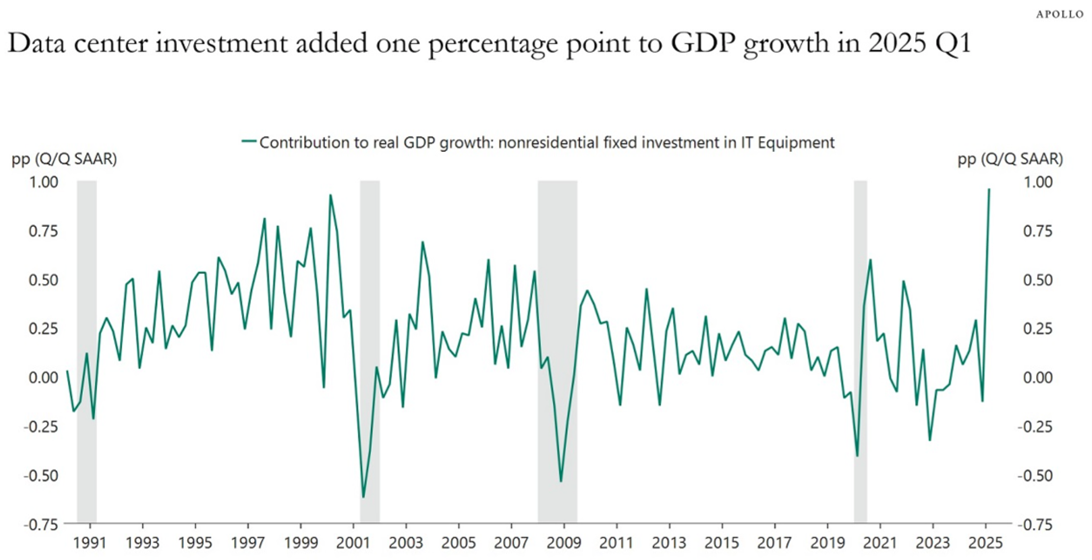

One additional data point we will share – the AI supercycle is not simply benefitting large technology companies at the forefront of this wave. AI is also helping the economy.

Data center investment, which is the key ingredient to building compute power for AI infrastructure, added a full percentage point to GDP growth in Q1, and that trend continued into Q2. Data center investments have contributed as much to the US economy in 2025 as consumer spending, which is a staggering figure considering that typically the consumer makes up 70% of the US economy.

This provides some cushion for the economy that even if the labor market is stagnant, we have a major tailwind in the form of AI infrastructure investment that can offset weakness elsewhere.

Source: Apollo Chief Economist

Market implications

While all of this wonky talk about the economy is nice, you may be asking “what does it mean for my portfolio?”

Our conclusion is that while the labor market is slowing down, we are still not calling for a recession in the near-term despite the negative headlines on jobs. We believe that this bull market and economic expansion is still mid-cycle. It seems logical to expect that this bull market will end when the AI bubble bursts.

One may also ask what this means for the Fed and interest rates, and how that may influence stocks. The market is now expecting the Fed to cut interest rates over the next few months, beginning later in September. We do not view this as a major tailwind for stocks given that the market has already priced in these cuts.

Despite this glass half full outlook for the economy, we do not expect stocks to march higher without any volatility along the way. We would not be surprised to see a 5-10% correction given how much the market has run up (the S&P 500 has gained +70% since the start of 2023, and +29% since the Liberation Day lows on April 8th). However, the big downturn still seems a ways off for now.