Is this AI driven bull market turning into a bubble?

It has been a hot summer for the stock market.

When we last wrote to you in May, we noted that markets were climbing the wall of worry after the Liberation Day mini-crash. Just two months later, there is not a whole lot of worry to be found on Wall Street.

Just over halfway through 2025, the S&P 500 and the tech-heavy NASDAQ are up around +8-9% while international stocks are up a blistering +19% in US dollar terms.

From the Tariff Tantrum lows on April 8th (just over 3 months ago), the S&P 500 is up +28% and the NASDAQ is up +38%.

Given the backdrop of an expensive market, high expectations for earnings, increasing tariffs, no cuts to interest rates, and several other macro headwinds, it is fair to ask what is going on and has the market lost its mind? The Wall Street Journal published an article last week asking this question:

To answer this question, it is helpful to look under the hood at cohorts of companies, rather than the stock market as a whole, to see what is actually happening. With this lens, the picture of recent market performance becomes clearer. There are two stock markets at the moment: AI leaders and everyone else.

Most of the global stock market is chugging along as one would expect – valuations are fairly close to historical averages and these stocks are performing in line with their underlying fundamentals.

The exception is the AI winners: tech giants that are aggressively pursuing artificial intelligence. These companies sport high valuations relative to history and make the broad indices look expensive/overvalued.

Of course this is somewhat simplistic as there are other smaller pockets of frothy valuations outside of the AI giants (meme stocks, some cryptocurrencies, etc.), but these segments of the market are a sideshow rather than the main event.

The stock market has determined for now that the AI tailwinds outweigh potential headwinds from tariffs and a slowing economy. If tech is the primary culprit for an expensive US stock market as a result of AI enthusiasm, the $64,000 question is whether the AI hype is justified or not. Before we answer that question, we will take a look at the market as a whole and then dive into recent developments in the world of AI.

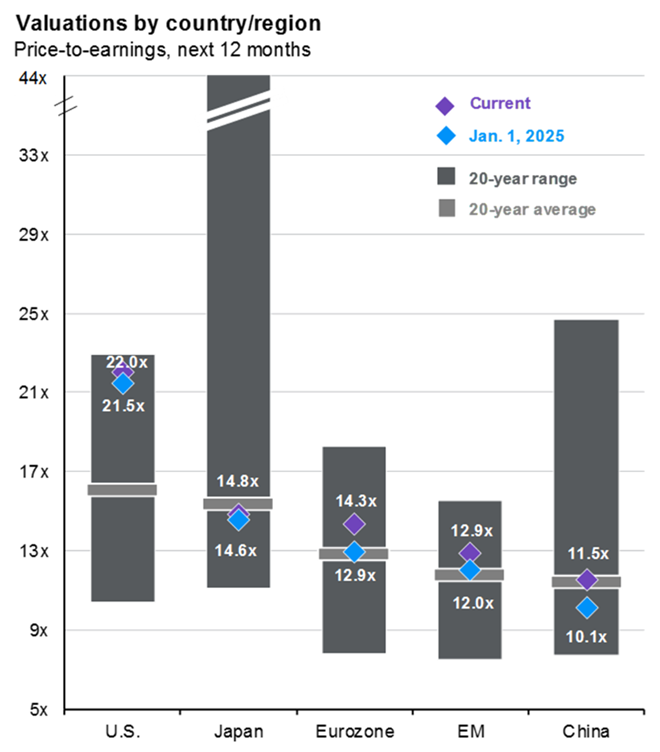

The US market stands alone in terms of high valuation

When you hear color commentators on CNBC complaining about high valuations in the stock market, they are referring to the US market. As the chart below shows, all other major regions are trading at or near their 20 year averages (the higher the diamond, the higher the price investors must pay for the next 12 months of profits in each region). Therefore, one can invest outside the US right now at reasonable prices.

Source: JP Morgan Asset Management

We are not advocating for investors to dump US stocks for international companies. There is a fundamental reason why the US trades at a higher valuation than other regions. The US is home to the best technology companies in the world that have grown faster than the top companies in other regions, and sport higher profit margins and more stable earnings (see our letter from March where we discuss).

Within the US, tech and AI winners are in a league of their own

Since the US is the primary area with high valuations, we will focus the rest of this piece on the dynamics at play in the US market.

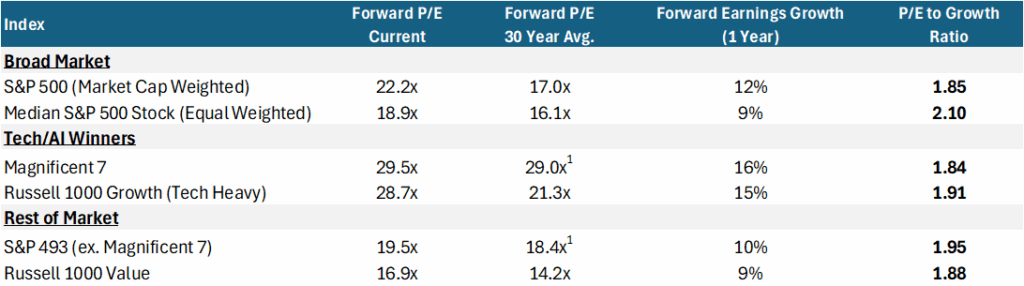

Even within the US market, it is a narrow set of companies (tech/AI companies) that are pulling up the valuation of the broader indices.

In the table below, we compared a selection of indices that best represent the AI winners and compared them to indices that could be described as “everyone else”.

No surprise, the indices that best represent the AI winners (the Magnificent 7, as well as the Russell 1000 Growth) have high valuations (28-29x earnings), and the rest of the market (the S&P 493 or the Russell 1000 Value) have much more reasonable valuations (17-19x earnings).

1 Forward P/E averages for the Magnificent 7 and the S&P 493 are 7 year averages given the length of the datasets. Source: 1911 Trust, Yardeni Research, JP Morgan Asset Management

However, as the old saying goes, “you get what you pay for.” The tech/AI winner baskets are growing much faster than the rest of the market, with 15-16% earnings growth compared to 9-10% for everyone else. When you adjust the valuations of these cohorts for their rate of earnings growth, the tech/AI winners are not more expensive than the rest of the market.

Is the AI hype justified?

AI enthusiasm is driving earnings growth and therefore higher valuations for tech companies, so the question is whether the AI supercycle will endure.

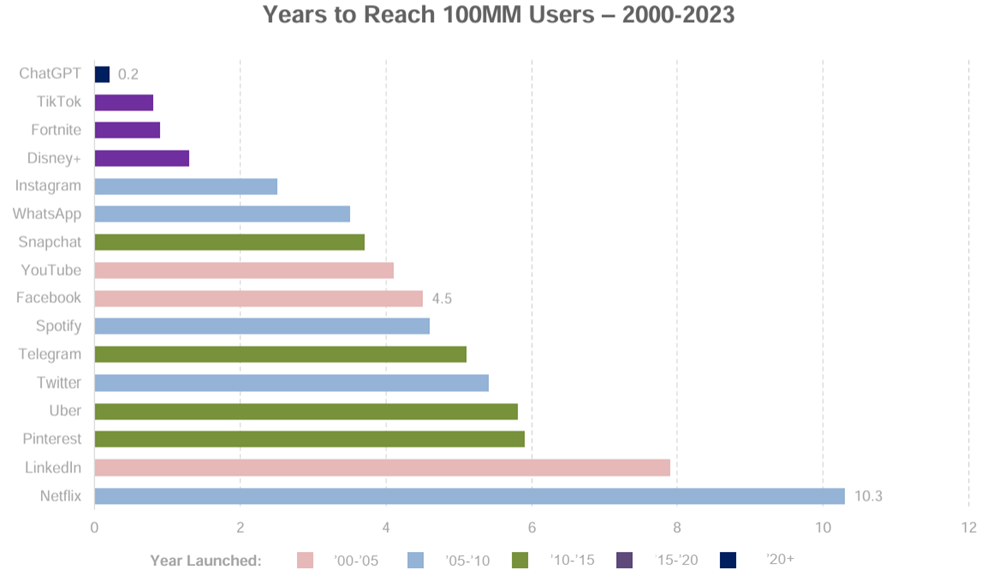

While there are always reasons to be skeptical about new technologies, it is hard to argue with the unprecedented growth and adoption of AI to this point.

ChatGPT launched in 2023 with a bang – reaching 100mm users faster than any internet company of the prior tech wave.

Source: Bond Capital’s 2025 “Trends – Artificial Intelligence” report

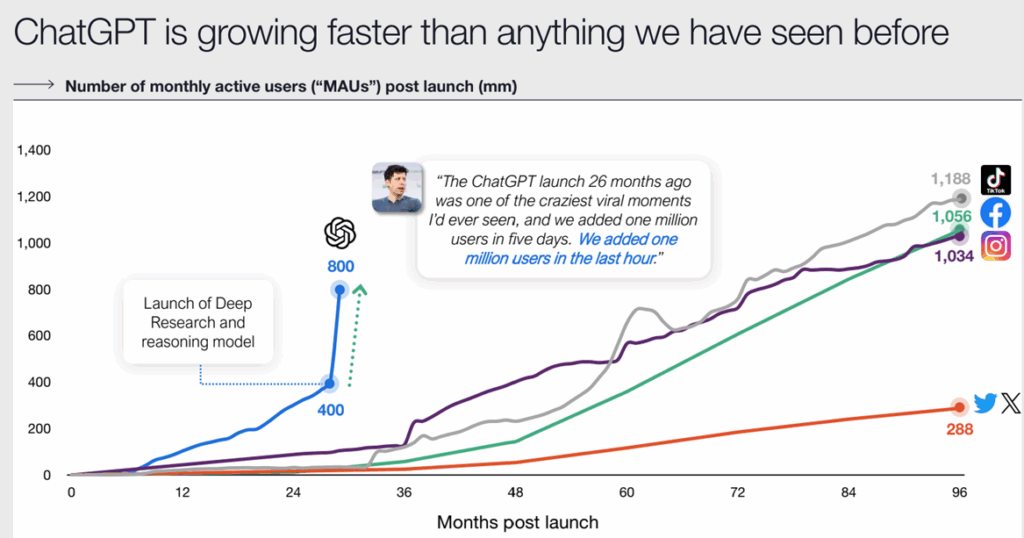

And ChatGPT’s growth just reaccelerated again earlier this year with the launch of their new generation of models, now serving over 800mm monthly active users. It took them roughly 30 months since launch to reach 800mm monthly active users, several years faster than any of the major social media platforms.

Source: Coatue Management

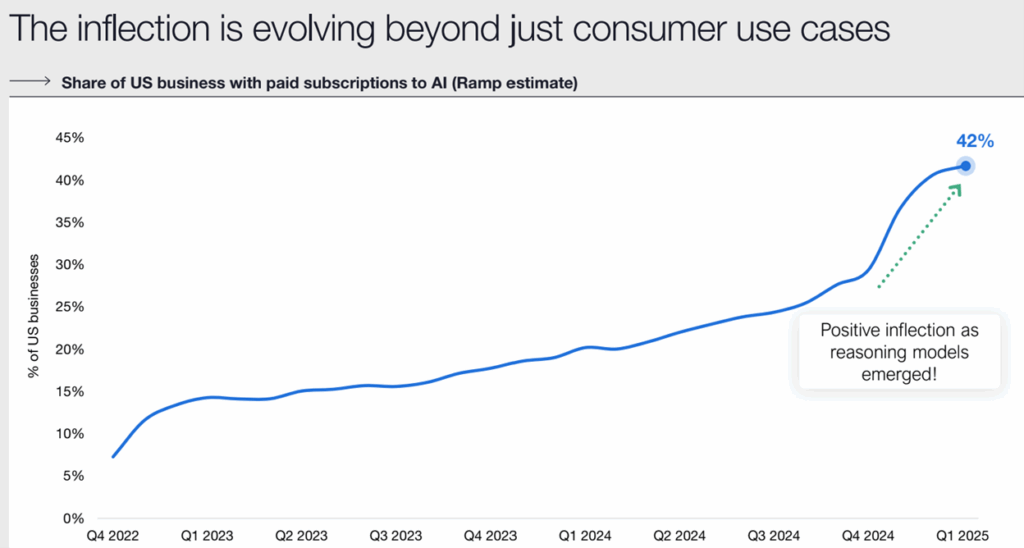

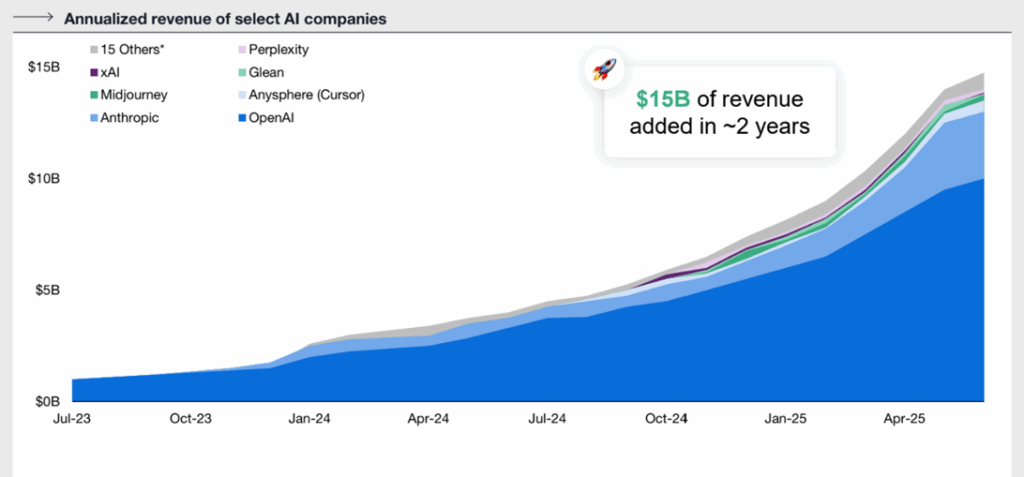

Eyeballs aren’t enough though. The Dot Com Bubble was littered with bad companies who were valued based on eyeballs and clicks. The good news is that AI companies have paying customers and are seeing meaningful revenue growth at scale.

Source: Coatue Management

Source: Coatue Management

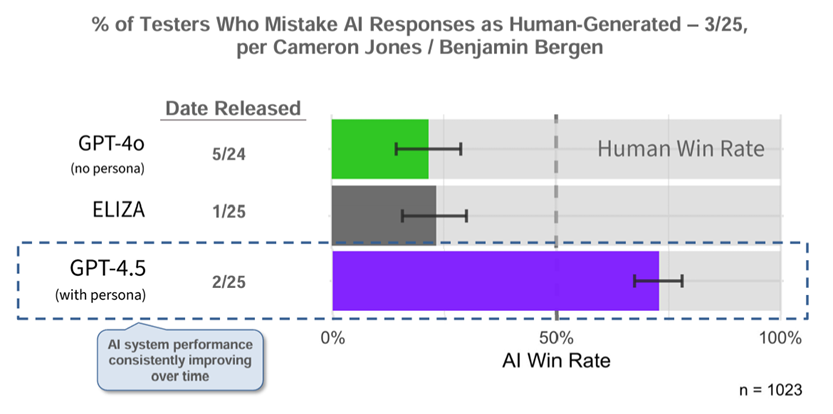

There is a reason why the growth rates are accelerating. AI models are getting better. For example, researchers at UC San Diego conducted a study where participants were asked to determine whether they were talking to a human or an AI model. The experiment was run with 3 AI models: ChatGPT’s old model (GPT-4o), a 1960s era chatbot called Eliza, and ChatGPT’s new model (GPT 4.5, released in February).

As the chart below shows, ChatGPT’s old model (GPT-4o) was not much better than Eliza at replicating humans. ChatGPT’s new version of their model (GPT 4.5), however, was nearly 3x more effective at generating humanlike responses.

Source: Bond Capital’s 2025 “Trends – Artificial Intelligence” report

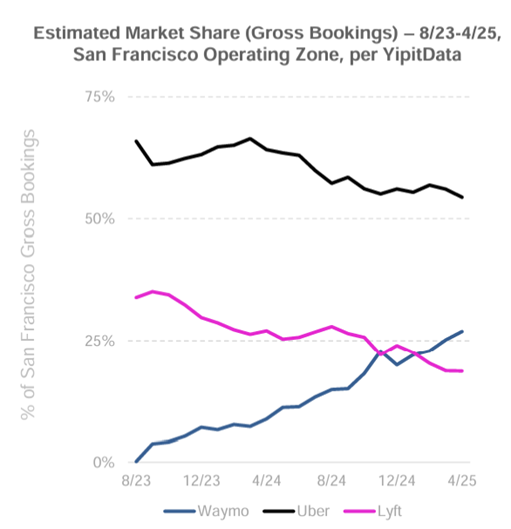

AI is not just a story about chatbots. Waymo, the autonomous vehicle company backed by Google, Andreessen Horowitz, and others, is rapidly becoming a formidable competitor to ride-sharing incumbents Uber and Lyft. In San Francisco, one of 6 cities where Waymo operates, the company has already overtaken Lyft as the #2 ride hailing service, and could be on track to challenge Uber for the top spot in short order.

Source: Bond Capital’s 2025 “Trends – Artificial Intelligence” report

Because these startups are seeing success and rapid adoption of their products, the race is on for developing new AI models as well as AI apps for consumers and businesses.

All of this spending is being funneled into a few main categories: compute power (i.e. Nvidia chips and cloud infrastructure from the likes of Amazon and Google), data center construction, and electricity/power generation. This enormous level of investment in AI infrastructure has benefitted the share prices of market leaders in these industries. This is the primary reason why the stock market has shaken off the macro concerns cited earlier.

What about the labor market?

We have received numerous questions regarding the societal impact of AI on the labor market, data security and privacy, and other legitimate concerns surrounding AI safety. We will not profess to have a crystal ball surrounding the impact of these risks.

On the labor market, we do believe that AI has the potential replace many jobs that exist today. However, we are encouraged by the fact that the world has seen countless waves of innovation and automation over the last 100+ years and the US remains fully employed today with more employed workers than ever, because new technologies tend to create new jobs that did not exist before. We will continue to monitor these developments and share our real-time thinking as the landscape evolves.

When will the music stop?

Nearly every prior innovation wave has eventually morphed into a bubble and ultimately burst. This doesn’t mean that the technology didn’t endure, and that longer term winners didn’t emerge (look at all of the successful internet companies founded after the Dot Com crash). However, one must be careful not to pile in at the top of the market.

No one knows when this AI supercycle will become an AI bubble. My hunch is that we are less than 3 years into this wave so it remains early in this investment cycle, and there is no slowdown in sight at the moment.

We are closely monitoring a few key indicators that could provide clues: IPO activity (historically we have seen spikes in IPOs in the late innings of bull markets), a slow-down in AI spending (watch the earnings of Nvidia, Amazon, Meta, and Google), or valuations that become so extreme that they completely disconnect from the earnings growth figures that tech companies are reporting.

Right now, it does not appear that many of these factors are in place, so we are not yet calling this a bubble. We would not be surprised if the market takes another breather (or even experiences a modest 5-10% pullback) at some point soon given the extraordinary gains experienced over the last 3 months, but we believe this bull market endures until the AI bubble ultimately pops.