Resetting market views after the recent rally, with a closer look at tariffs, artificial intelligence, and market expectations.

“Bull markets climb a wall of worry” is a longstanding proverb on Wall Street that many of us have heard countless times during our investment careers. While it is an unoriginal way to kick off this writing, it seemed appropriate for what we have witnessed in the markets over the last several weeks.

Before the market regained its footing during its climb up the wall, the S&P 500 had dropped -19% from February 19th (an all-time high for the market) through April 8th.

There were three primary culprits for this sell-off, one that is often discussed and two that are sometimes overlooked.

- Tariffs, which we discussed in detail in our last blog, Prisoner’s Dilemma . At the time, we wrote that both the US and its trading partners have strong incentives to de-escalate the trade war and strike deals, as the tariff rates disclosed on Liberation Day were unsustainable. Generally speaking, this seems to be the direction of travel as forecasted.

- AI concerns. Deepseek, the Chinese open sourced AI model that was built supposedly for a fraction of the cost of US counterparts. This supposed breakthrough cast a large shadow of doubt on the need for trillions of dollars of AI spending to build world-class cutting edge models. If AI spending was going to decline as a result of Deepseek’s breakthrough, then that would in turn be a negative on the corporate earnings for US technology giants that have powered index returns over the last several years.

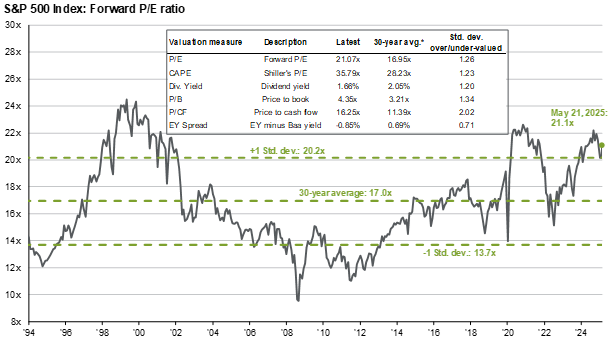

- Valuations and expectations. The market was just too expensive, and expectations were too high. This is the boring answer that will not grab headlines and attention, but was a key ingredient for the volatility we saw earlier this year. If valuations and expectations had been lower, Deepseek may not have been as big of a problem, and even tariffs may not have caused as much turmoil as they did (look at Europe, where their stock market held up very well during the tariff tantrum, because valuations and expectations were low heading into the storm).

Since April 8th, the markets have roared back amidst a cooling down of the trade war temperature, with the S&P 500 returning +16% and the NASDAQ posting a +22% gain. There are few, if any, market participants who predicted this type of rally in early April.

This is the essence of the wall of worry. Stock prices tend to rise in the middle innings of a bull market despite negative headlines, poor sentiment, and reasons to be cautious. On top of that, we have additional risks that have entered the zeitgeist (Moody’s US debt downgrade, US tax and spending policy, among others).

We came into 2025 more cautious than most, expecting a volatile year and flat performance (2025 Outlook). We are 40% of the way through the year, and that is exactly what we’ve gotten (the S&P 500 has returned -1% in 2025 with plenty of volatility). International markets have been a bright spot, with the MSCI EAFE index returning +16% in 2025 and the Euro Stoxx 50 gaining +22%.

The million dollar question is what now? We will frame the discussion using the 3 ingredients for the market sell-off earlier this year (tariffs, AI, and market expectations) as a guide toward where we may be headed. Spoiler alert – our near-term outlook is unchanged.

Update on Tariffs

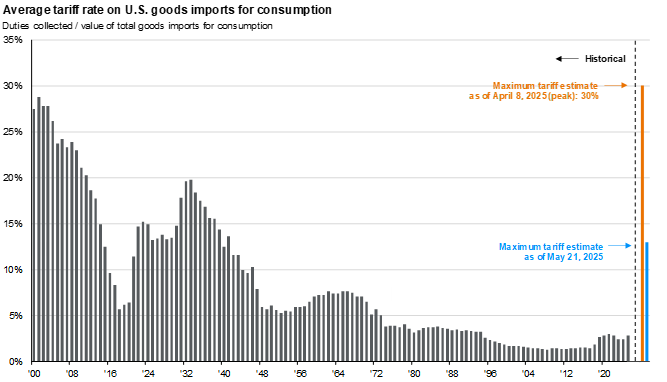

We entered 2025 with an average tariff rate of 3% on imported goods.

The Liberation Day announcement increased the average tariff rate to 30%, a level that was likely to lead to significant economic damage.

After a series of pauses, adjustments, and negotiations, the average tariff rate on imports resides at around 13% (not including a potential 50% tariff on the European Union and a 25% tariff on Apple’s iPhones, both of which were floated last week). The final levels remain a moving target.

While a 13% tariff rate is less painful than 30%, a 10% increase in tariffs (from 3% to 13%) acts as a fiscal tightening mechanism regardless of who bears the brunt of the tariff increase.

Whether consumers pay higher prices, or whether companies eat the cost, someone has less money in their pocket. Either way, that is a headwind for corporate earnings, and therefore the stock market.

Artificial Intelligence

One of the benefits of our job is that we spend our days meeting with the top investors in the world in their respective fields. These meetings yield on-the-ground insights that do not make it into the newspapers, but provide a richer picture of what is happening at individual companies in real time.

Here were some of the headlines from Q1 that warned of a slowdown in artificial intelligence spending as a result of China’s Deepseek model, which was reportedly built at a much lower cost than OpenAI’s ChatGPT and other AI models built in the West.

Forbes.com – February 1st

The Economist – January 30th

We could go on, as there were countless articles trying to call the top on artificial intelligence. What we’ve heard on the ground suggests that the AI ecosystem is alive and well, with meaningful progress in recent months.

One technology investor told us that OpenAI’s growth is experiencing significant reacceleration, recently reaching 800 million active users (doubling in just a few weeks). OpenAI launched ChatGPT just 31 months ago. For reference, it took Facebook 96 months to reach 1 billion active users.

Microsoft noted in their recent earnings call that the AI usage on their cloud platform grew 5x year-over-year through March, and the growth in AI usage is accelerating.

A former CEO of one of the largest global technology companies told us there has been significant progress in the advent of AI agents (AI that can perform and complete tasks, rather than just reply to questions). He predicted that within two years, companies will no longer need computer programmers, because AI agents will be able to respond to verbal instructions and perform just about any task it is asked to perform on a computer.

This view was reinforced by one of our venture capital managers who recently shared groundbreaking results in some of their portfolio companies, including one AI company that grew its revenue 75x in the last 9 months, and is now generating several hundred million dollars of revenue (and a significant increase in valuation as a result).

AI has unlocked the ability for technology to disrupt larger markets than ever before. Today, software companies generate $300 billion per year in revenue globally. These software companies are largely legacy technologies attacking smaller incumbent markets. AI is going after big fish – the labor market, transportation/logistics, manufacturing, and healthcare, which make up huge portions of global GDP. The prize for AI companies is magnitudes larger than the prior wave of software winners.

We remain early in the lifecycle of AI, and many roadblocks remain in place (but also present opportunity). The key limitations, we’ve been told, are access to semiconductor chips and power, which should provide ample return opportunity for companies in these sub-themes.

While it is easy to be pessimistic about markets in the face of a barrage of negative macro headlines, we remain optimistic about the ability for skilled technology investors to generate strong performance in artificial intelligence, and we have allocated our capital accordingly.

Valuations and expectations

While we are excited about artificial intelligence delivering healthy returns over the long-term, the market setup in the short-term remains somewhat problematic.

The S&P 500 never got particularly cheap during this recent bout of volatility and continues to trade at 21x earnings.

Not only does the market remain expensive, the expectations for earnings growth also remain quite high, particularly in the face of higher tariffs. The market has tempered earnings growth forecasts for this year (dropping from 15% to 9%) but still has 13% growth baked in for 2026 and 2027 (vs. the long-run average of 7-8%).

AI vs. Macro – running in place for now

The combination of these factors leaves our 2025 outlook unchanged. We continue to expect a choppy market and muted returns over the next several months. We do not expect that 2025 will be the end of the bull market that began in 2023. We have some optimism that the bull market can resume toward the end of 2025, or in 2026, as AI efficiency gains start to filter through to corporate earnings, particularly if macro headlines abate.

With this backdrop, we have not made any changes to our long-term equity targets in portfolios. For investors that are overweight stocks, we are using market rallies to take chips off the table and build up additional liquidity. And we continue to partner with top-tier technology investors in both the public and private markets as the best way to access the winners of the AI revolution.