Why allocating to areas of innovation is a winning strategy for long-term investors

In 2022, many investors and market prognosticators predicted that the era of technology sector dominance was coming to an end. At that time, inflation was peaking at 9.1%, the Federal Reserve began a historically aggressive rate hiking cycle, and the common logic was that the “bubble” in technology stocks was bursting after an artificially driven rally powered by a decade of zero interest rates. The party was over.

Here were some of the headlines from that era:

Financial Times – February 28th, 2022

Financial Times – March 9th, 2022

CNBC – September 7th, 2022

There is no question that ultra low interest rates benefitted a lot of mediocre (at best) companies by allowing them to raise significant amounts of capital at high valuations despite being years away from any potential profit. These marginal businesses are still trading at a fraction of the valuation they commanded during the peak years of 2020-2021.

Many of the charts and commentary provided below come from a presentation I made in June of 2022 for teammates and clients at my prior firm. The argument I made at the time was that investing in the highest quality, most innovative companies in the world (in both public and private markets), and doing so with a very long-term time horizon, remained a key ingredient to building a winning portfolio, despite the sell-off we saw in 2022.

Innovation solves the world’s problems, so securing equity ownership in the businesses that create products and services to address these issues is a path to high long-term performance. To avoid the “faux innovators”, or businesses that appear to be innovators but end up being fads, investors are best served by partnering with the best fund managers in the world (both in public and private markets) to analyze and access these businesses.

What transpired over the last 2 years since the dark days of 2022 has proven once again that innovation continues regardless of the macro backdrop. The rise of artificial intelligence, a dominant theme in the markets over the last 2 years, came in a period where scarcity was one of the biggest risks facing the economy – scarcity of labor, goods, and services. AI and automation is a solution to scarcity.

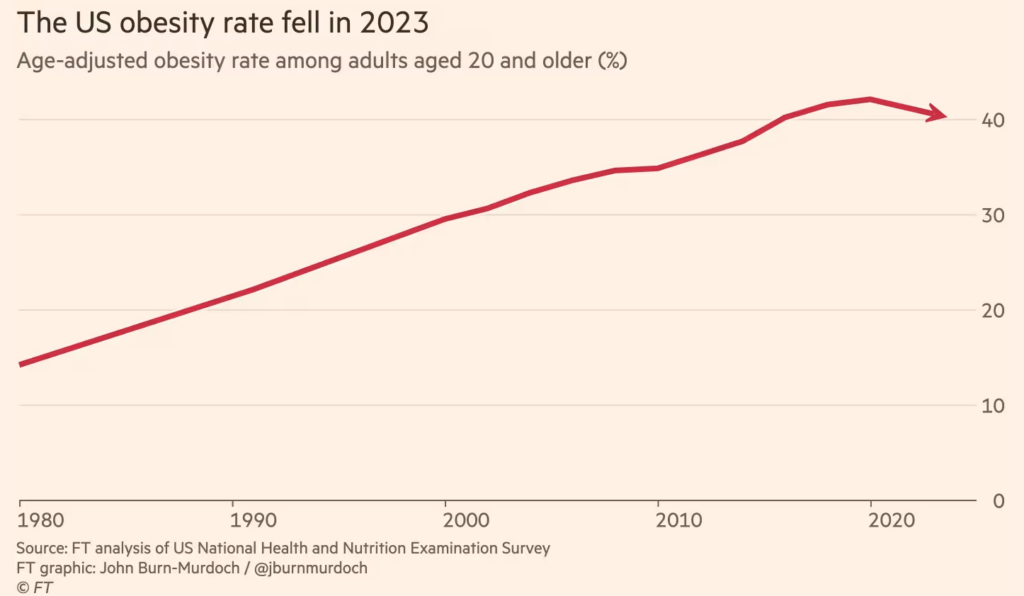

Obesity, an issue that over 100 million Americans face, is another problem that innovators have tackled over the last 2 years with the rollout of weight-loss drugs Ozempic, Wegovy, Mounjaro, and others. For the first time in decades, the obesity rate in the US declined last year. This is innovation at work solving real challenges.

Despite AI powering a +72% return in the NASDAQ since June of 2022, and pharma companies Eli Lilly and Novo Nordisk (the makers of the top weight-loss drugs) seeing share price gains of 130% to 190%, some of the same questions regarding innovation investing still exist:

Are we in another tech bubble like we saw in 1999/2000?

Will venture capital ever generate strong returns again? Or is the asset class broken?

Is AI the next big fad like the metaverse?

In the near-term, nobody knows what will happen in the markets. We’ve had a great run over the last 2 years in public markets (venture capital is still in the early stages of its recovery), and the market’s mood can swing from positive to negative at any moment for any reason.

Prior innovation waves go through fits and starts (the dot com crash of 2000 is the most notable example, yet in hindsight we were still very early in a multi-decade secular trend of internet adoption). So volatility is going to surface, there will be ups and downs.

I am confident though that over the long-run (which I define as at least 10+ years, maybe even 20+ years), the best way to compound capital and have a chance of outperforming comes from investing in innovation, and doing so with high quality businesses and fund managers.

Why does this strategy work? And what is the evidence? Let’s take a look:

Quality of life has improved significantly over the last 200 years

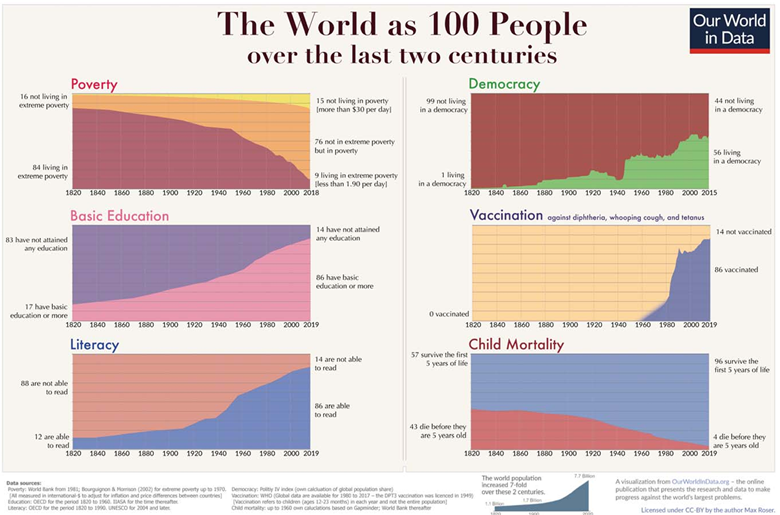

Despite all of the challenges the world faces everyday, quality of life has improved based on a wide array of different measures. The percent of people globally living in extreme poverty has declined from 84% 200 years ago to 9% today. Literacy rates have increased by 7x. Child mortality has declined by 90%.

Innovation has driven quality of life improvements

Without innovations such as basic medicines, electric power generation, and new modes of transportation, it is hard to envision all of these improvements in quality of life from which we’ve all benefitted. Innovation solves problems.

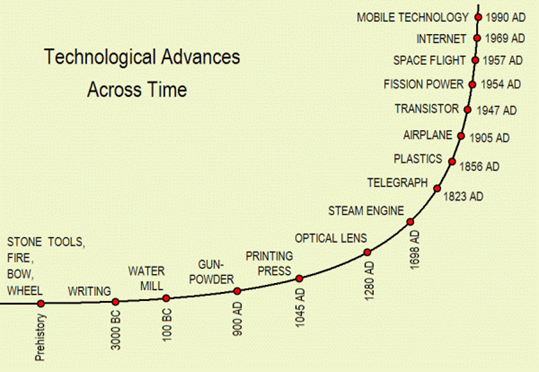

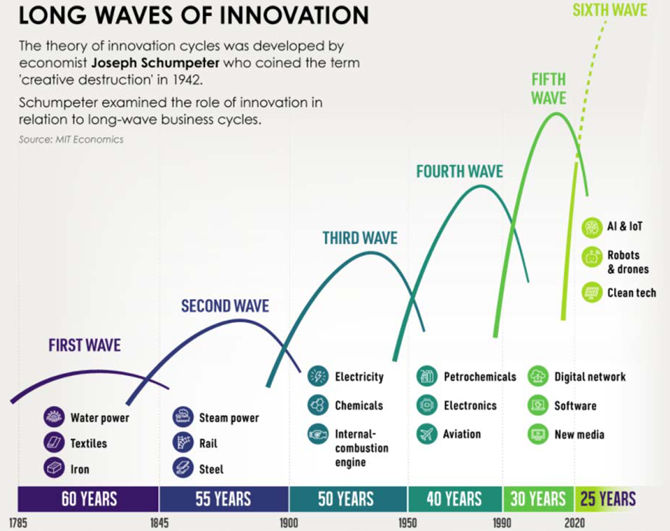

And innovation curves do not slow down, they accelerate and compound on each other (for example, you can’t have artificial intelligence without cloud computing, you can’t have cloud computing without the internet, and so on). Each innovation wave happens faster than the prior wave, and often takes place at a larger scale (and this has been true since the beginning of time).

Quality of life improvements have driven stock market gains

The improvements in quality of life are not only profound advances for society, but these developments are great for the economy and the markets. Since 1928 (the year before the Great Depression started), the S&P 500 has delivered a 300x return despite the US economy having 15 recessions (shaded in gray below), a World War, hyperinflation in the 1970s, a financial crisis, and a global pandemic.

Innovation drives disruption

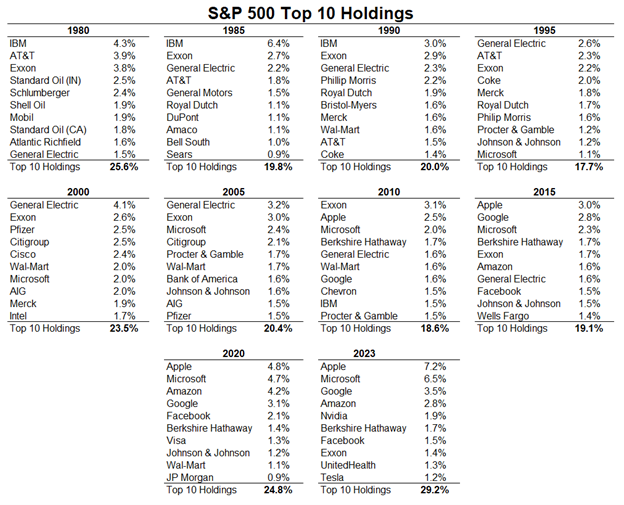

As innovation accelerates, new winners emerge and upend the leadership of the incumbents from the prior waves. This requires investors to continue investing to keep pace with technological advances. Looking at the top 10 companies in the S&P 500 over time, most companies do not stay in the top 10, they end up underperforming the up-and-coming, more innovative businesses.

Of the top 10 stocks in the S&P 500 at the end of 2023, only 1 of them was in the top 10 in 1990 (Exxon). 5 of the 10 biggest stocks in 2023 hadn’t even been created yet in 1990 (Google, Amazon, Nvidia, Facebook, Tesla – all VC backed).

Even more impressive, 18% of the S&P 500 companies were VC-backed prior to IPO, and the total market cap of these companies represents 44% of index today. If you want to invest in the future leaders of the economy and markets, venture capital is a good place to start, for those who can access it.

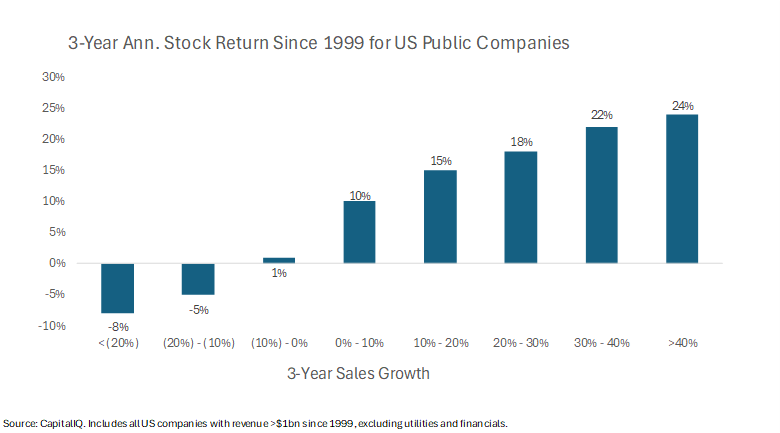

Higher growth leads to higher returns

Even for those investors who cannot allocate to venture capital, investing in innovation in the public markets leads to better performance than avoiding innovative sectors and businesses. There is a direct correlation between sales growth and stock performance for companies as evidenced by the dataset below.

Additionally, the NASDAQ (purple line), which tracks faster growing innovative companies, has generated almost 5x more in gains than the broader market (blue line) over the last 30 years.

Will this trend continue? Look at the incentives…

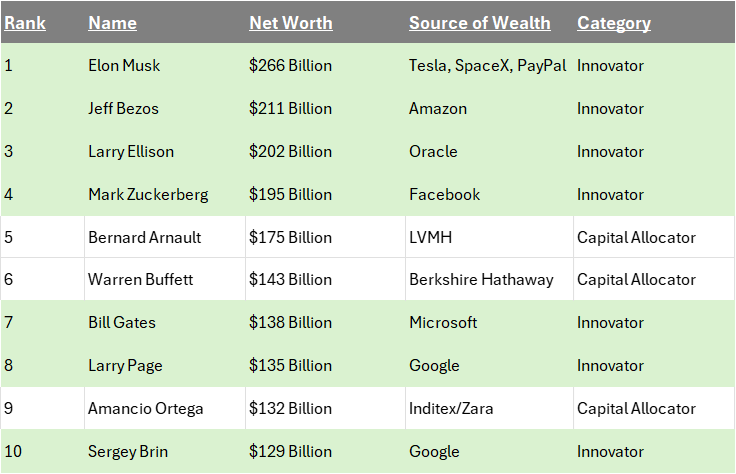

Humans will continue to innovate because they are incentivized to do so. 7 of the 10 wealthiest people in the world founded innovative technology companies, which demonstrates the types of rewards available to both entrepreneurs and investors in new technologies. Of course, the mission to solve problems is a key motivator for entrepreneurs to start a business. But, financial reward is also a driving force behind talent and capital flows.

As long as governments create an environment that is supportive of innovation, I remain optimistic on the long-term trends discussed above.

Let’s say a government were to block IPOs of its largest private companies, deem certain sectors as “banned” overnight, or were to take a heavy handed regulatory approach on its most successful businesses because they were too successful – what would happen in this scenario?

Look no further than China. These actions taken over the last 3 years have led to a period of weak economic growth and poor stock market returns (at one point the Chinese stock market fell -59%). Venture capital activity has screeched to a halt, and foreign capital has left.

Over the last two weeks, China’s government has recognized the need to revive sentiment, and has enacted a number of stimulative measures to boost confidence in their economy and markets. The market has rewarded these new policies as Chinese stocks have risen +35% over the last two weeks. We are watching closely to see if China has truly turned the corner on these anti-innovation policies, and plan to discuss further in future posts.

Long-term trend is higher but expect volatility

While the long-term trend in innovative businesses is higher, these fast growth businesses are always subject to volatility. Investors in innovation get too excited from time to time, and overinflate the values of these businesses. Everyone remembers the dot-com bust, when the NASDAQ fell -78% from its peak. We also saw a -35% drawdown in the NASDAQ in 2022 as the COVID bubble burst. However, even if you had terrible timing and invested in the NASDAQ at its peak in 2000, you would be sitting here today with a +260% gain.

At the individual stock level, the volatility is even greater. Amazon is viewed as one of the most successful innovative companies in the world, returning +205,188% since its IPO in 1997. Along the way, Amazon has experienced 9 corrections of at least -25%, 4 drawdowns of at least -50%, and a -95% crash when the dot-com bubble burst.

The winners of this AI supercycle will experience similar levels of volatility. Not every company will recover when volatility strikes. But there will be at least a handful of businesses that create products and services that add real value to their customers, and investors in those innovative businesses will reap the benefits.